By Katherine Zobre

Alabama Small Business Development Center Network

Katherine.zobre@ua.edu | 201-503-5927

As the COVID-19 crisis continues to evolve, financial resources are making headlines. Unfortunately, as resources continue to become available, so does inaccurate or outdated information, scammers and predators. So first, let’s review some cybersecurity tips (more tips here):

- Use strong and different passwords for all your logins. (The most common password is ‘password.’ The second most common password is ‘1234567’. That’s easy pickings for hackers!)

- Verify the source of information. SBA.com is not the Small Business Administration’s website!

- Don’t click on links in emails you don’t recognize. And don’t ever email social security numbers, passwords, or banking information.

- Verify you are talking to a real person from a real organization before giving details of your personal or business life.

Now down to business: There are three main tools available to your small business. Each has a different source of information, different decisions and different timeline for when it will actually make a difference in your business. How do you keep track? This post breaks it down.

1. Your cash flow management decisions.

Every decision you make about the spending and chasing money is a cash flow decision. If you decide to discount inventory to move it fast – that’s a cash flow decision. If you decide to spend money on SEO marketing – that’s. a cash flow decision. If you decide to prepay or pay for a year of auto insurance – that’s a cash flow decision. You can see how nearly every business decision is related to your cash flow. So, if you’re not the type of business owner that enjoys pouring over your balance sheet, profit and loss, and schedule of liabilities, there are a few resources to help. We call these folks your BAIL Team: Banker, Accountant, Insurance Agent, and Lawyer. Of course, the ASBDC, REV, and many other organizations are here to help you make sense of the numbers and prioritize spending, but your BAIL team is there to help you out during these tough times too.

FREE WEBINAR SERIES

PREPARING TO BORROW

A 3-part series developed by partners Urban Impact, Operation Hope, Sabre, ASBDC, LiftFund, Trufund and REV

Session 1: Assessing Your Needs

Tuesday, April 7 | 1 – 2 p.m.

Session 2: Understanding Commercial Loans

Wednesday, April 8 | 1 – 2 p.m.

Session 3: Applying for a Loan

Thursday, April 9 | 1 – 2 p.m.

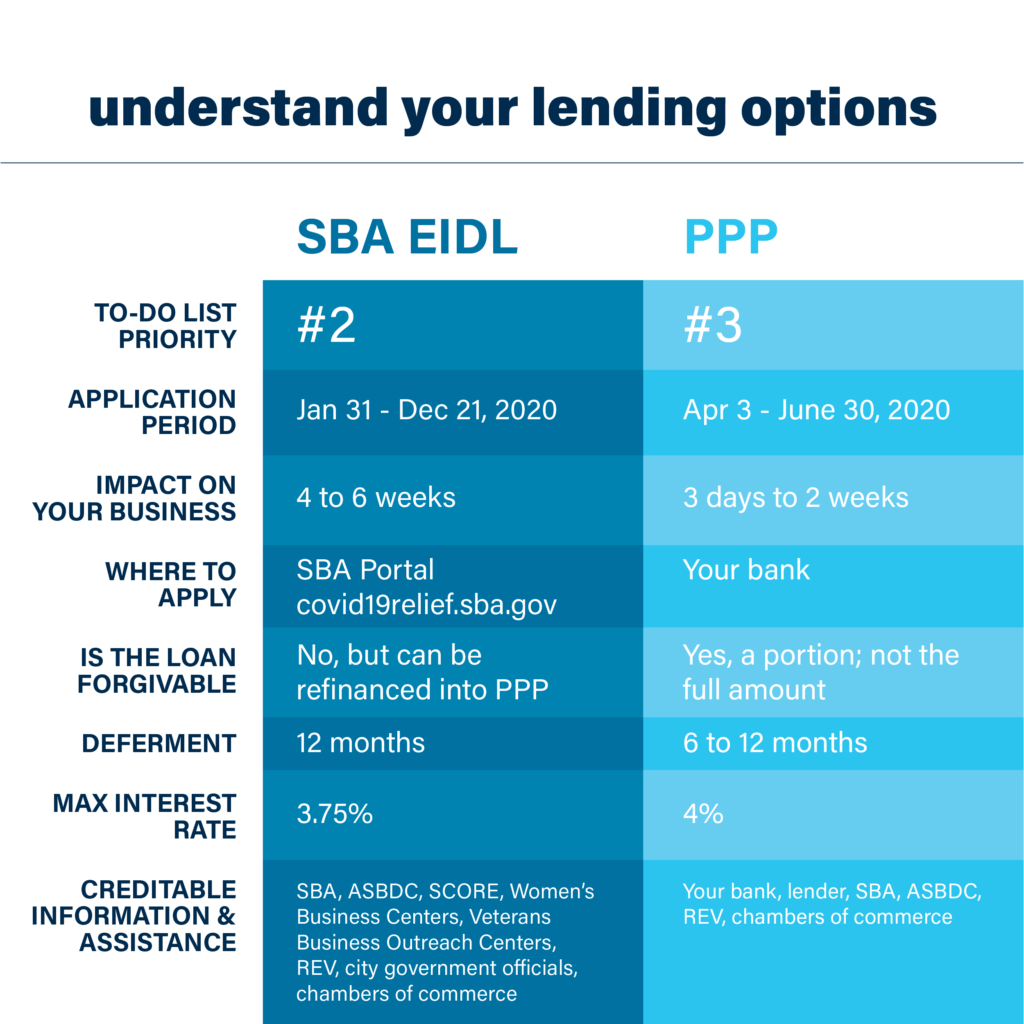

2. SBA Economic Injury Disaster Loan (EIDL)

The SBA Economic Injury Disaster Loan (EIDL) program application is on the third version. This program is primarily for paying fixed operating costs (rent, utilities, loans, etc). These applications take 4-6 weeks to review and corresponding directly with SBA loan officers. If you previously applied, and want to request to be considered for the $10,000 advance on the PPP, fill out the latest online SBA EIDL application. If you applied for the SBA EIDL before 3/30 and did not receive a confirmation of the submission, submit the new SBA EIDL application. While there sounds like a hefty amount of overlap between what the PPP and EIDL can be used for, “double-dipping” is not permitted. For example, if you use the PPP for payroll, use the EDIL for rent.

3. Paycheck Protection Program (PPP)

The PPP is a part of the CARES Act. A portion of this loan will be forgiven IF the borrower abides by the stipulations, of which there are many (remember your BAIL team!) Small businesses, sole proprietorships, independent contractors, and many non-profits qualify. This loan can be used to cover payroll, payroll costs related to the continuation of group health care benefits, employee salaries, commissions, or similar compensations. Additionally, mortgage interest payments, rent, utilities, and interest on any other debt obligations that were incurred before February 15, 2020 are also eligible expenses.

How to prepare for the PPP: Gather the following documents:

-

-

- 2019 IRS Quarterly 940, 941 or 944 payroll tax reports

- payroll reports for a twelve-month period (ending on your most recent payroll date),

- 1099’s for independent contractors,

- documentation showing a total of all health insurance premiums paid by the company owners under a group health plan (employees + owners),

- documentation on retirement plan funding that was paid by the company owners (but not funding that came from employee paychecks).

-

LOAN APPLICATION CHECKLIST

The administration soon will release more details including the list of lenders offering loans under the program. In the meantime, the U.S. Chamber of Commerce has issued this guide to help small businesses and self-employed individuals prepare to file for a loan.

There are a lot of details so take your time to understand the implications of each financial resource. The Alabama Small Business Development Center, REV, and many other support organizations are here to help you through these decisions and applications.

The Alabama SBDC at the University of Alabama is a member of the Alabama SBDC Network, a statewide service network. Funded in part through a cooperative agreement with the U.S. Small Business Administration. Hosted by the University of Alabama. Nationally accredited by the Association of SBDCs. All opinions, conclusions or recommendations expressed are those of the author(s) and do not necessarily reflect the views of the SBA.

Related News

-

The Key Tool for Urban Revitalization: Downtown BHM's Business Improvement District

Filed Under: Business-Proving, Developer, Downtown Birmingham, Front Page, Get Involved, Potential-Proving, Why BHM

By the time REV took on BID management in 2018, downtown had a new set of needs from its BID. Downtown Birmingham in the ‘90s had a population mainly of 9 to 5 employees. But the downtown of 2018 had a whole new population of residents and visitors throughout the day and night. We had new opportunities to create positive experiences, inviting them into more downtown businesses and public spaces, and to keep them coming back for more.

-

Introducing the six businesses that call Nextec home

Filed Under: Business-Proving, Developer, Downtown Birmingham, Filling Vacant Spaces, Front Page, Historic Preservation, Potential-Proving, Why BHM

On the corner of 3rd Avenue and 16th Street North, you’ll find Nextec, a redevelopment of the 90-year-old, 65,000-square-foot Edwards Motor Company building (also formerly known as the Sticks ‘N’ Stuff building). With experience in historic renovation, developer Michael Mouron, chairman of Capstone Real Estate Investments, began this civic project in 2021 as a space for business startups to continue their work in the Magic City – a function encouraged by REV Birmingham.

-

Woodlawn Marketplace: Nurturing retailers, building community

Filed Under: Birmingham Food & Drink, Business-Proving, Family Friendly, Front Page, Magic City Match, Potential-Proving, Small Business, Woodlawn, Woodlawn Street Market

Since autumn of 2021, Woodlawn Marketplace has stood tall in its place at 5530 1st Ave S. Originally planned as a month-long mini market experience featuring seasoned Woodlawn Street Market vendors, the project was met with such a positive reception that the REV team decided to press on and launch a larger, more permanent version. In the months following that decision, the space has undergone a transformation, evolving into a local retail incubator and café. Now, the heart and soul of the marketplace is supporting local businesses and building community in the historic Woodlawn business district.